Banks keep evolving themselves to provide better services and methods of communicating with clients. Over the past many years, banks leveraged technologies and innovation to facilitate their services to users.

For example, during the 1960s comes the ATMs. Ten years later, card swipe machines for payment became active. At the start of the 21st century, people started using web-based banking services. Moreover, in 2010 powerful mobile banking came into action.

Regardless, the progression of the financial structure; bank services, and banking operations didn't stop there. Now the computerized age is opening up new ways of digitalization, making opportunities to utilize AI or Artificial Intelligence in banking.

Quick Navigation

- Is Artificial Intelligence in Banking Relevant

- What Are the Uses of Artificial Intelligence in Banking

- AI-powered Chatbots

- Mobile Banking Apps

- Data Collection and Analysis

- AI Increase Data Security

- Algorithmic Trading

- Consistent Automation Process

- Cutting-edge Security

- What is the Future of Artificial Intelligence in Banking

Digitalization is the substance of this age and technology is its transporter!

The systems are sought after at the fingertips. Here, the PC and computer addressing skills have developed and are making customer relationship management simple, practically easier in each industry.

Huge information is the business standard today. Furthermore, every region is working on understanding all that it could from the vaults of unstructured data and information.

Accordingly, banking as a business is additionally evolving. Not simply utilizing the advantages of artificial intelligence in data structuring yet in the banking service and Fintech strategies.

The impact of artificial intelligence or AI in the banking sector is progressively stepping in to use and further develop client relations.

However, the question arises --

Is Artificial Intelligence in Banking Relevant?

In a couple of our conversations with the top banks, it cleared that air that banks are searching for ways to provide better services. Also, finding new strategies to beat contenders and other greater banks.

Therefore, the bigger banks are utilizing computerized strategies and fresh technologies for banks assessment, money-related assessment, profiling chefs, credit support measures, KYC, and against tax avoidance frameworks.

"By 2023, banks are projected to save $447 billion by applying AI apps in their banking processes."

For affiliations working in the financial business, it has gotten continuously basic to remain aware of competition and addition their remaining as a creative organization.

Also Read: How FinTech Application Development Transforms the Banking Industry

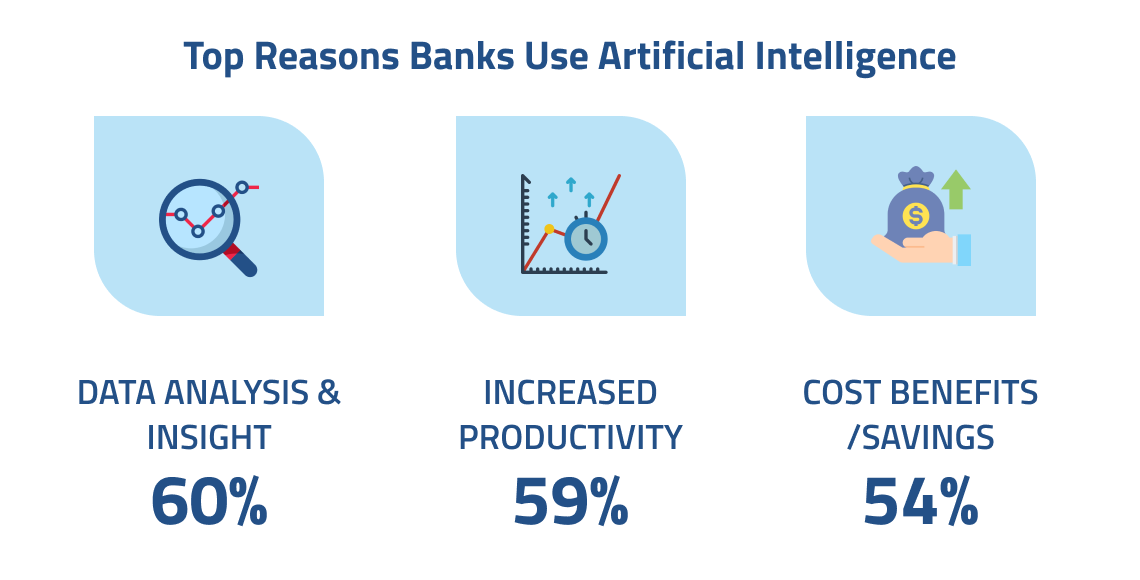

This shows clarifications behind AIs broad appropriation in Banking and Financial Services. What's your opinion about AI applications in the financial business? What is the impact of artificial intelligence on banks working?

"Enables superior customer experience, Personalized banking, Data-driven smart insights, Enables a smooth flow of information, Data-driven decision-making, Improved business operations, AI-driven risk management, Fraud prevention, Better auditing, Mitigates cybercrime, Creates a compliant internal structure, Smooth Card management system, are some of the top benefits of artificial intelligence in banking and finance."

What Are the Uses of Artificial Intelligence in Banking?

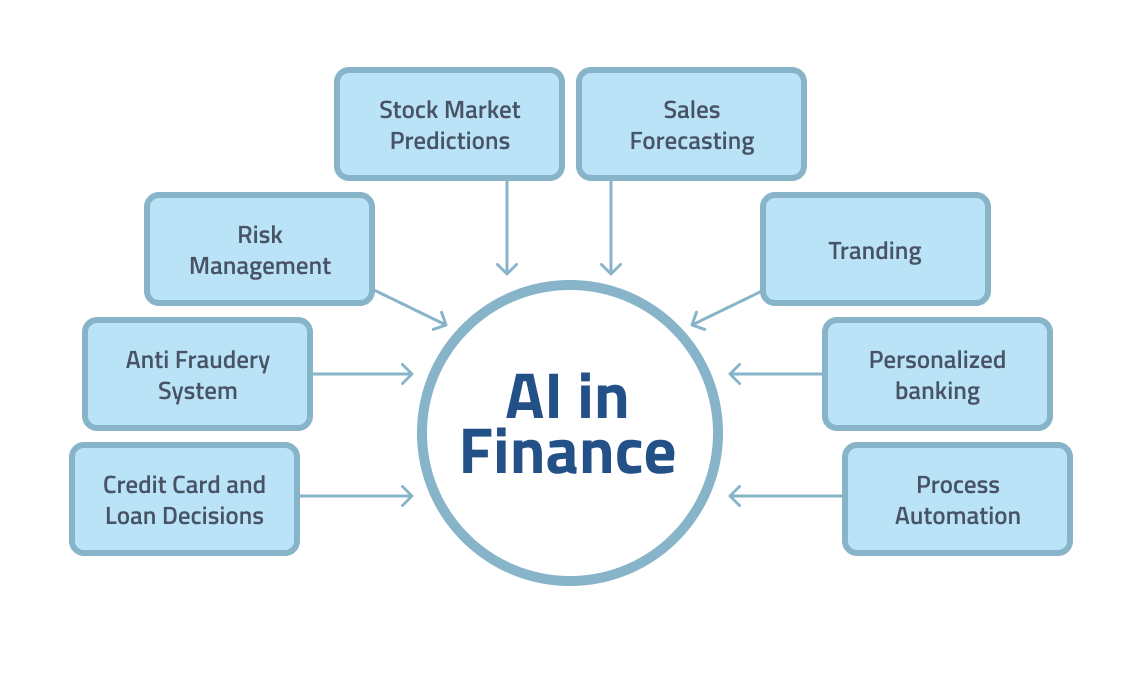

Artificial intelligence in the banking sector makes banks efficient, dependable, supportive, and thoroughly smooth. It is fortifying the upper hand of current banks in today's digital time.

The positive impact of artificial intelligence in the banking sector limits operational costs; thus, automating bank processes and increasing customer support.

The following are a portion of the AI use cases in banking from the top banking and finance software solutions provider that will change the Finance and FinTech business in the coming years.

AI-powered Chatbots

The present chatbots are AI-empowered! They communicate with a huge number of customers for the benefit of banks. Integrating chatbot services is simple in mobile apps.

Thus, a bank can help its clients and effectively settles on undeniably more informed decisions. Additionally, chatbots tackle many banking issues identified with cards, withdrawals, banking accounts, and other banking services.

"As per reports, banks and financial establishments save 4-minutes with every customer conversation when utilizing chatbots or banking bots."

Mobile Banking Apps

AI-functionality is daily expanding in mobile apps, making banking services more personalized, proactive, and progressed. With AI, banks can produce 66% more revenue utilizing a mobile banking application.

In the event that you have plans to further develop banking operations and services in the cutthroat market, then, at that point do use banking applications of AI.

"For instance, you can likewise incorporate Google Assistant for Android users or Siri for iOS users as did by the Royal Bank of Canada."

Also Read: How Machine Learning and AI transform Banking

Data Collection and Analysis

The banking sector records billions of transactions! Banking establishments have a volume of data and information, data gathering and collection are also difficult. Moreover, data structuring is a staggering task for employees!

Here come the AI apps effectively gathering data, keeping it free from dangers, analyzing it appropriately, and giving a superior customer experience. As per the reports, Big Data and AI in banking apps have diminished the cost.

AI Increase Data Security

Credit card frauds are the most widely recognized kind of fraud enlisted each day in the banking industry. However, if we use AI-based systems, it triggers an additional degree of security, makes the cybersecurity of your banking system solid, and acts effectively against malicious components.

Amazon is vigorously investing in AI and Machine Learning to make Amazon Pay and Amazon banking better.

"Before the finish of 2022, the spending on AI for cybersecurity purposes will be more noteworthy than $120 billion!"

Algorithmic Trading

Individuals are presently utilizing very good quality systems and AI models that take a few contributions from various sources and gives you the best investment decision.

These days, 70% of trading is utilizing AI for better data social occasion, and decision-production. In this manner, AI makes high-recurrence trades with better information close by.

Consistent Automation Process

Artificial intelligence has incredible potential in the banking industry. It automates each errand that is finished by humans and simplifies the whole interaction. Straightforward, AI can decrease the responsibility in banks.

AI automation in banking diminishes the responsibility of an employee. It can serve the customer's 24*7. With the assistance of banking apps and Chatbot, users can get total information on opening or shutting the record or transfer of assets, and so forth.

Cutting-edge Security

Artificial intelligence provides significant level security services to banks. AI banking apps make each transaction more secure, speedier, distinguish hazards, and limit fraudulent demonstrations.

AI technology can check transactional data and identify unpredictable user behavior designs. Henceforth, utilizing shrewd AI apparatuses and apps, banking organizations can shield their business from breaks.

What is the Future of Artificial Intelligence in Banking?

80% of banks see the advantages of AI. 75% of them are using AI services in their banks and financial institutions. 46% of banking organizations have fully AI-based frameworks.

AI services and systems have become a principal piece of banking organizations' progression strategies, helping them with remaining mercilessly keeping watch.

Also Read: Features to Implement in A Mobile Banking App to Ensure Its Success

In any case, artificial intelligence in banking is right off the bat in its reception stage. The AI opportunities for the banking sector are huge. This development limits working costs further develop client help and robotizes measures.

The technology will give many benefits to the banks just as financial organizations. Regardless of whether it is an Android or iOS app, AI will be a distinct advantage in the banking sector.

"Data Protection and Data Security, Attracting New Customers, Insufficient Tech Knowledge, and Problems in Blockchain Adoption are a few difficulties in the banking and FinTech industry."

Considering everything, clearly, AI is putting down deep roots, and is influencing a huge number of enterprises. Among a few industries, banking is an early adopter of AI mobile applications.

A good time for AI in banks in the coming years is guaranteed. On the off chance that you are keen on making an AI-based banking service application, contact the AI solution provider in the USA.

Brainstorm your idea with us, and begin developing your banking app soon. Our experts know AI, Machine Learning, Deep Learning, Predictive Analytics, NLP, etc. useful in developing premium mobile app solutions for your business development.